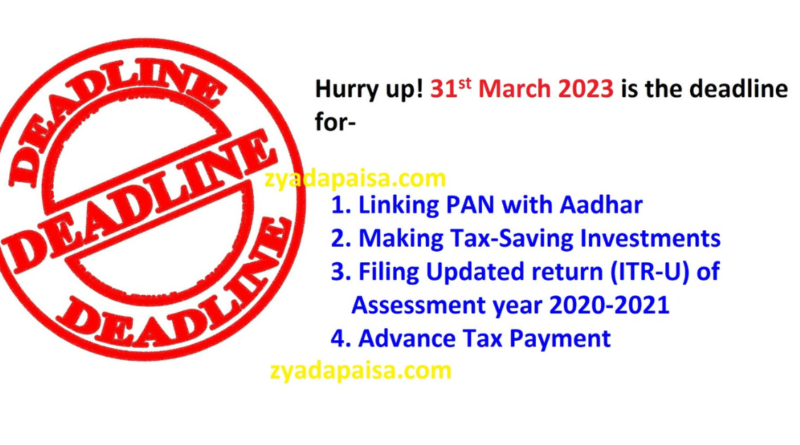

Hurry up! 31st March 2023 is the deadline for :

- Linking PAN with Aadhar

- Making Tax-Saving Investments

- Filing Updated return (ITR-U) of Assessment year 2020-2021

- Advance Tax Payment

Link your PAN with your Aadhar Card

As per The Income-tax Act,1961, now it is mandatory for all PAN holders (except those who fall under the exempt category) to link their PAN with their Aadhar Card on or before 31st march 2023. If you fail to do so, your PAN will become inoperative from 1st April 2023. This means you will be unable to use your PAN card for various purposes if you do not link the PAN with your Aadhar up to 31/03/2023.

Fees of Rs. 1000/- will be charged by Department if you want to link your PAN with Aadhar.

If you still have not linked the PAN with Aadhar, you can go to the below link:

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar

Make Tax Saving Investments before 31/03/2023

As the financial year 2022-23 is about to complete, all of us must make investments to save the Income tax liability for the current financial year. Taxpayers should buy the eligible investments on or before 31st march 2023. Investments made After 31/03/2023 would not be eligible for deduction for the Assessment year 2023-24. Investments under sections 80C, 80CCD (1), 80D, etc. are eligible for deduction from Gross total Income.

So those assessees who wish to invest in Life Insurance, PPF Accounts, Health insurance, Mutual Funds, Tax Saving Fixed Deposits, National Pension Scheme, etc., or those who want to donate to Charitable institutions or political parties, etc. should do so before 31st March 2023 so as make their payments eligible for deduction under the Income Tax Act

ITR-U of Assessment year 2020-2021

Read more about ITR-U…..Click here

The Finance Act, of 2022 introduced the new ITR filing facility known as an updated return. A new sub-section 8(A) was added to Section 139 of the Income-tax Act for this purpose. This new section provides the chance to update your ITR within two years. This scheme came into effect on April 1, 2022. Any person who has made an error or omitted certain income details in the original return of income, belated return, or revised return can file ITR-U.

For the Assessment year 2020-2021, two years are completed on 31st March 2023, so taxpayers have to file ITR-U for Assessment year 2020-2021 on or before 31st March 2023 otherwise it cannot be filed after that date.

Even the assessees who have not filed the Original ITR for Assessment year 2020-21 can file their return in ITR-U Form. But a minimum of Rs.1000 late fee will be charged for filing the form along with the amount of due tax liability.

Payment of Advance Tax Liability

As per the Income Tax Act,1961, 15th march 2023 is the last date to make the payment of the final installment of advance tax. Otherwise, taxpayers will have to bear the penalties and interest under sections 234B and 234C of the Income Tax Act,1961. Remember, here the last date of advance tax is 15th march and not 31st march for normal assessees but taxpayers opting for presumptive taxation can make the entire payment of tax in advance up to 31st march 2023.

Note – Investments are subject to market risk, conduct research and apply discretion before investing