Alert! New Rules for Bank Lockers

Banks are directed to renew agreements with the Customer

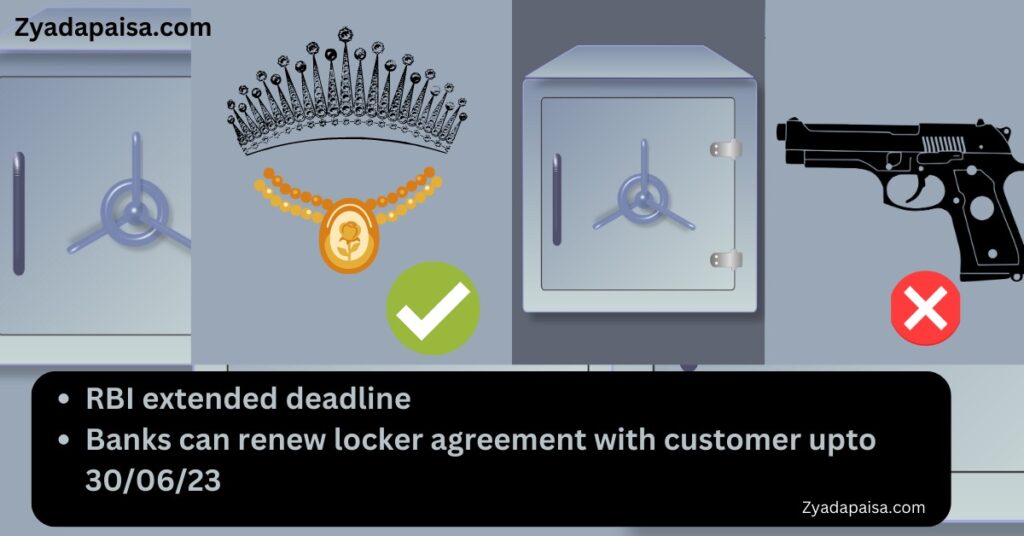

RBI notified that the agreement between customers and banks can be renewed up to 30th June 2023 instead of 1st January 2023. Earlier RBI Notified that Banks should renew the Locker Agreement with the customers latest by 1st January 2023, now date has been extended to 30th June 2023.

The Reserve Bank of India recently said that it has been decided to extend the deadline for banks to complete the process of renewal of agreements for safe deposit lockers in a phased manner by 31st December 2023 whereby 50% number of agreements should be renewed by 30th June 2023 and 75% agreements should be renewed by 30th December 2023.

Earlier Reserve Bank of India vide circular no. RBI/2021-2022/86 DOR.LEG.REC/40/09.07.005/2021-22 dated 18th August 2021 notified some of the crucial measures, some of which are –

1. Banks are directed to renew their agreement with customers for safe deposit Lockers by 1st January 2023. (Now the date extended to 30th June 2023)

2. In case, where the customer is having the locker in the bank but neither operates the locker nor he pays the rent, for such situation’s banks are allowed to obtain a Fixed Deposit from the Customer at the time of allotment which would cover three years of rent and charges for breaking open the locker in case of such eventuality.

3. The locker hirer and/or the persons duly authorized by him/ her only shall be permitted to operate the locker after proper verification of their identity and recording of the authorization by the officials concerned of the bank. The bank shall maintain a record of all individuals, including the locker hirers, who have accessed the lockers and the date and time (both check-in and check-out time) on which they have opened and closed the locker and obtained their signature.

4. As per the Circular, Customers are only allowed to use the locker as long as they pay the rent. New safe deposit locker agreements have been introduced by banks, specifying that customers can only use lockers for legitimate purposes, such as storing Jewellery and documents.

5. The agreement now prohibits the storage of any cash or currency. Further arms, weapons, drugs, contraband, perishable or radioactive materials, or any material that could create a hazard or nuisance to the bank or customers cannot be stored in the locker.

Other Notified points are –

6. Banks shall take necessary steps to ensure that the area in which the locker facility is housed is properly secured to prevent criminal break-ins.

7. All the new mechanical lockers to be installed by the banks shall conform to basic standards/benchmarks for safety and security as prescribed by the Bureau of Indian Standards (BIS) or any other enhanced industry standards applicable in this regard.

8. Banks offering electronically accessed lockers should be fully aware of the safety and security features of such lockers.

9. Banks shall ensure that the identification Code of the bank/branch is embossed on all the locker keys.